Tariff Tug-O-War: How Trump’s Tariffs are Affecting Both Large and Small Businesses

By Ellie Long ‘25

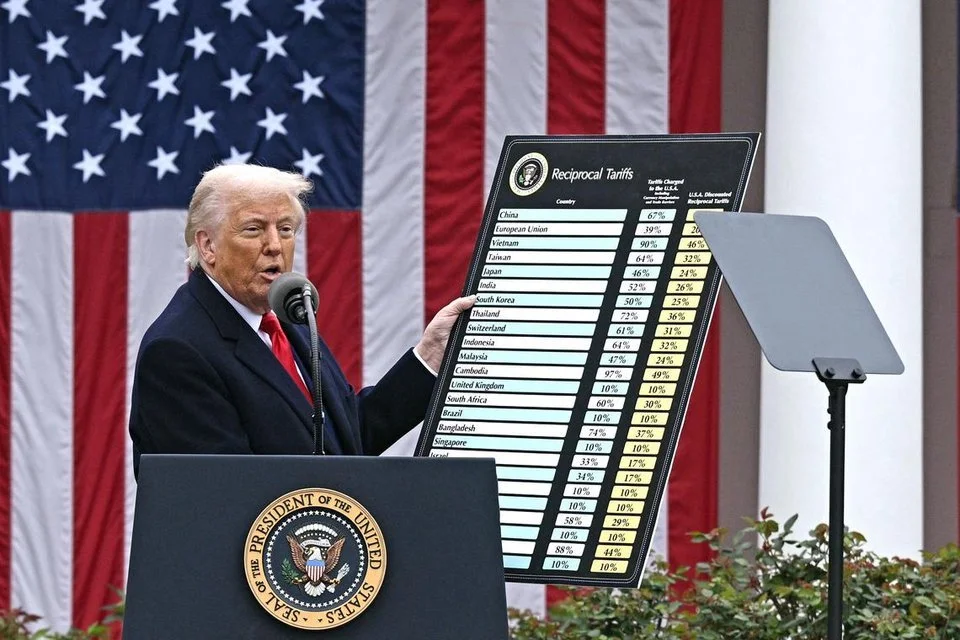

The Trump Administration's recent tariffs are causing significantly unstable markets for companies across the country due to new import duties on products from nations all over the world. There have been up to 145% tariffs placed on Chinese goods and 10% tariffs for a majority of other countries. Some of the resources that these tariffs will apply to are steel and aluminum, cars, and smartphones/computers. President Trump argued that these tariffs will protect jobs and promote U.S. manufacturing, but disregarded the fact that the world economy has been thrown into turmoil while also raising prices.

Tariffs are taxes that are charged on imports brought in from other countries and are calculated based on a percentage of the product's value. For example, a 10% tariff on goods means that a $10 product would receive a tax of $1, bringing the total cost of the product to $11 (Clarke 2025). However, with Trump’s 145% tax on Chinese goods, the total cost of a $10 product would rise to $24. The tax from these imports goes straight to the U.S. government.

Trump’s reasoning for establishing these tariffs is to reduce the gap between the value of products that the United States purchases from other countries and the goods it sells to them. He further claims that these taxes will encourage U.S. consumers to purchase more American-manufactured goods as well as increase levels of investment and taxes raised. While Trump continues to defend his decisions on the tariffs, many of his Republican Party members have joined Democrats and foreign leaders in voicing their concerns for the detrimental effects of these taxes. The International Monetary Fund (IMF) predicts that the global economy will increase by 2.5% in 2025, which is lower than the previous year which was 3.3%. The IMF also expects a recession in the United States in 2025.

Many businesses will be hit hard by the tariffs, but small businesses face an especially serious threat. Smaller companies have spoken out and say they fear for these new tariffs as they will have to choose between either raising the prices they charge their customers or taking the financial hits of the taxes. The increased tariffs can lead to disruptions in supply chains, prevent companies from receiving their products, increase wait time for customers, and ultimately result in a loss of revenue if customers can find the product elsewhere. Most small businesses have fewer than 500 employees and account for half of all private sector employment in the United States. Since smaller businesses do not have as much financial flexibility, they are more vulnerable to tariff costs. The Small Business Majority, a national small business organization that empowers America's diverse entrepreneurs, conducted a recent poll that found 53% of small business owners in the United States are concerned about the impacts that Trump's new tariffs will impose. This problem is further exacerbated for small businesses since some of them are suppliers for larger retail companies. These larger companies stated they would not allow an increase in prices which puts more pressure on smaller businesses and further drives a power imbalance between retailers and suppliers.

Trump says his tariffs will help to revive American manufacturing by influencing domestic and foreign companies to construct new factories in the United States. However, both large and small businesses do not have the capacity to quickly shift their supply chains, given the high cost of labor in the U.S. Overall, the new tariffs are posing a destructive threat not only to the entire world, but the economies of both small and large businesses in America.

Ellie Long is a senior majoring in political science.

Sources

Berkowitz, B. (2025, April 5). Trump's tariffs are a nightmare for companies big and small. https://www.axios.com/2025/04/05/tariffs-force-companies-prices-layoffs-bankruptcy.

Clarke, J. (2025, April 22). What are tariffs and why is Trump using them?. https://www.bbc.com/news/articles/cn93e12rypgo.

Logan, M. (2025, April 22). How Trump’s Tariffs Impact Small Businesses And Entrepreneurs. https://www.forbes.com/sites/micahlogan/2025/04/22/the-impacts-of-tariffs-on-small-businesses-and-entrepreneurs/.

Picchi, A. (2025, April 8). Small businesses say they fear Trump's tariffs: "A devastating impact". https://www.cbsnews.com/news/trump-tariffs-china-small-business-tax-imports-impact/

Small Business Majority. (2025, March 3). New Tariffs Will Put Small Businesses at a Competitive Disadvantage. https://smallbusinessmajority.org/press-release/new-tariffs-will-put-small-businesses-competitive-disadvantage gad_source=1&gbraid=0AAAAADi8UY47wH3oXqxJUXpzt4rvYjkVH&gclid=CjwKCAjwq7fABhB2EiwAwk-YbH0UeXr_GoAYlBs_JjkGbL8jye5NKCuPdOvbBfydnhe2lJrFgX1cUhoCI2oQAvD_BwE.